Hey. My name is Joseph and I’m the co-founder and CEO at Supademo. We help anyone create beautiful, interactive product demos and guides in seconds using AI.

I’m writing this blog post on the heels of closing our oversubscribed round during what’s been described as the worst time in history to raise capital.

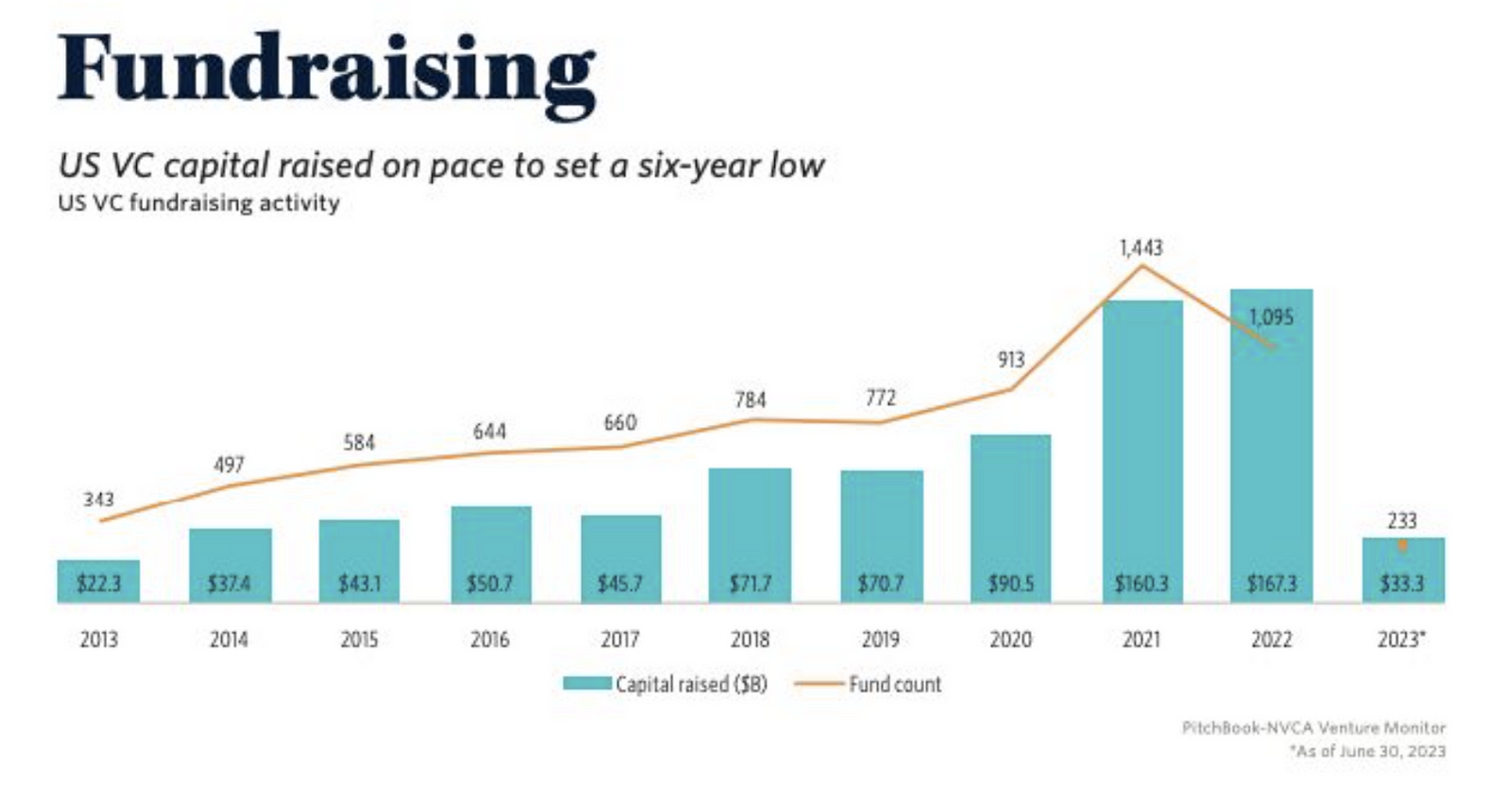

In fact, capital raised in 2023 is about to hit a 7-year low, mirroring the grim outlook we’ve seen across mass layoffs, dwindling tech stocks, and slowing economic growth:

Having gone through a month-long process to raise capital, I felt this pain firsthand. Luckily, I had the support of numerous advisors, mentors, and peers — who helped share their tribal knowledge and lessons to help propel Supademo to a successful outcome.

With this post, I’m hoping to stitch together the snippets of advice, tactics, and tools I used to create the playbook I wish I had at the beginning of my fundraise. I think it’ll be a valuable tool for founders' exploring a fundraise this year (or during any economic downturn).

My hope is that you’ll leverage these lessons to (1) spend as little time on fundraising so we could go back to building and (2) find values-aligned investors (“smart money”) that will amplify your mission.

Without further ado, here’s my fundraising playbook, if I had to do it all over again:

Day 0–3: Do you want to do this?

First, you have to be real with yourself and identify why you’re embarking on a fundraise. Are you doing it for the glory? Because someone told you to? Or because you believe your company is at an inflection point between opportunity and market timing?

Taking on venture capital is not for everyone. For most VCs, the economics of investing only work for companies that have the ‘potential’ of generating significantly outsized returns — where 1–2 breakout investments have the propensity to returning the fund (thus, offsetting all other portfolio losses).

So by definition, you need to be exploring an opportunity that can scale quickly and deliver on these outsized expectations. Ultimately, you could have a great business that becomes an extremely profitable company — but it’s not apt for raising capital from VCs (angels and/or family and friends is another avenue, though!).

If you’ve decided to pursue funding…

Mentally prepare yourself for the string of rejections and internalize the difficulties of raising during an economic downturn vs. a bull market/low-interest rate environment. This includes:

- More investors dragging their feed without an urgency to make a decision

- Lengthier and more dragged out due diligence

- Lower valuations, less assumption of risk

Days 3–7: Prepare Your Stack

Once you’ve committed to the fundraise, make sure all of your ducks are in a row. Let’s start off with the tools we used at Supademo:

- Canva and Journey.io for crafting our pitch decks

- Supademo for building an illustrative, interactive product demo

- Docsend (you can get up to 90% off the first year) to keep your deck, demo, and data room gated behind email access (this is critical)

- MailTrack to track responses and reads

- Loom for short, <5 min narrated versions of the pitch deck

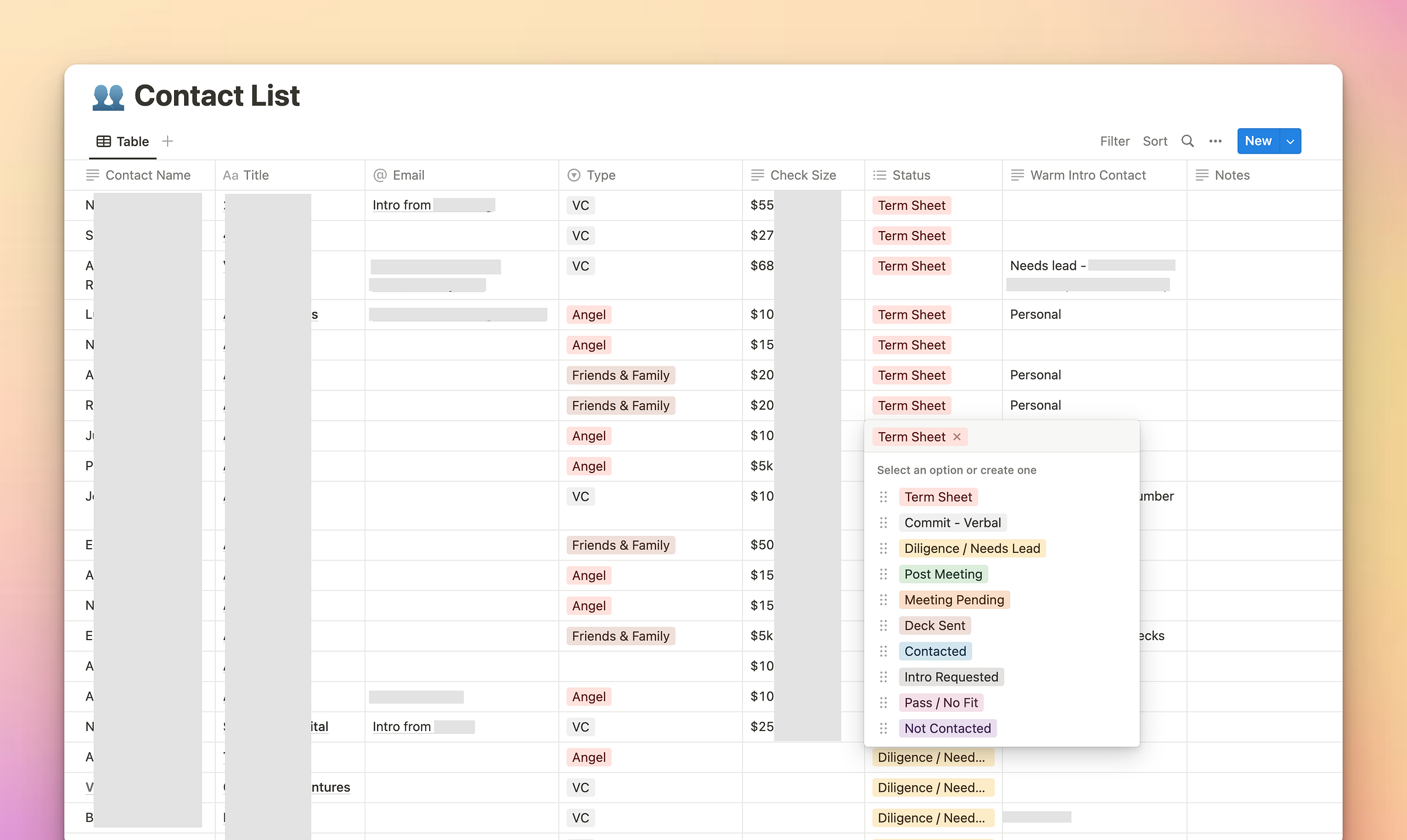

- Notion for tracking investors and their statuses

After getting your tools in order… you should:

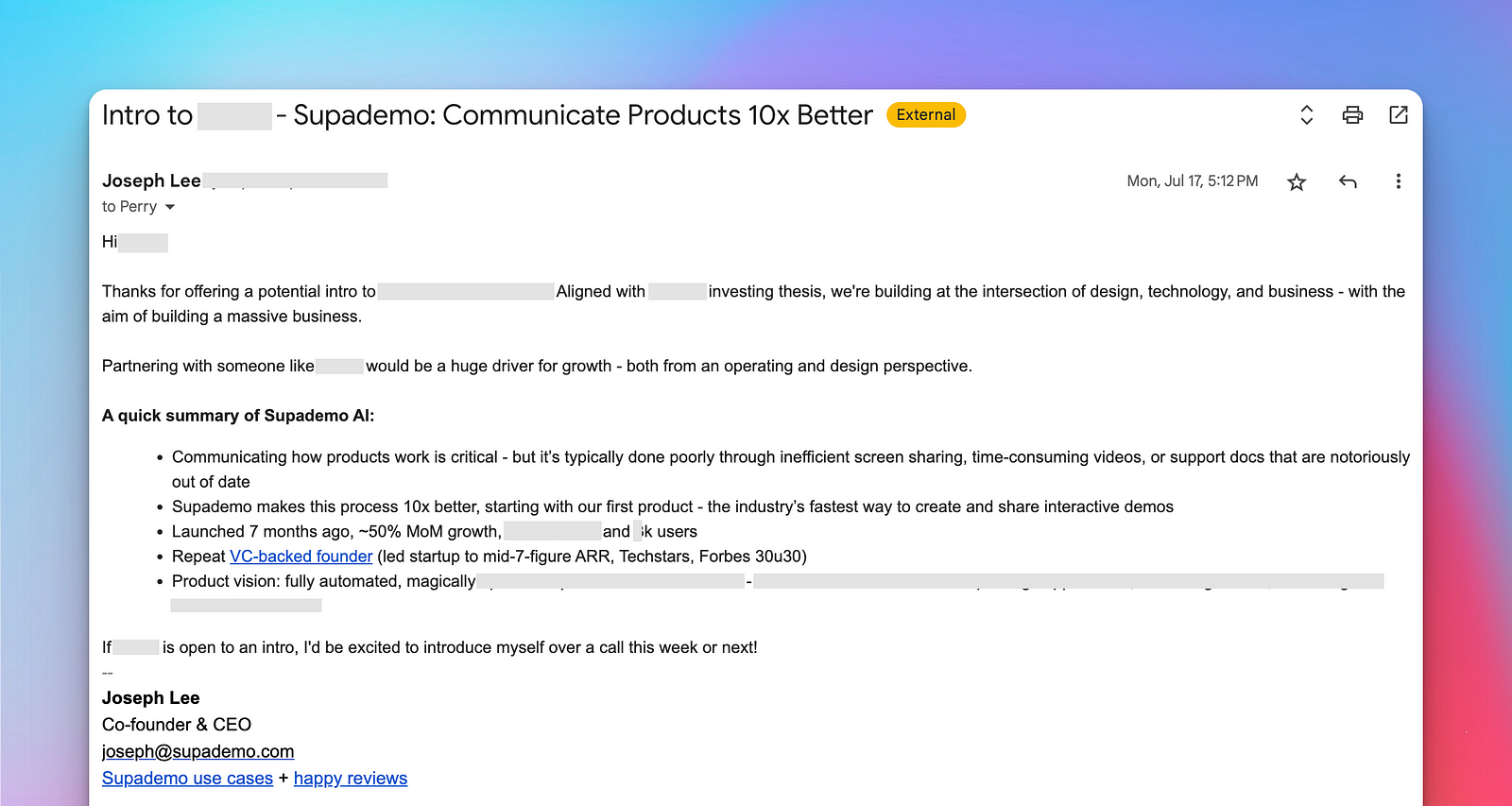

Finalize your blurb: a quick, 2–3 sentence overview that quickly encapsulates what you do, market opportunity, traction, and team. This should provide an accurate overview of your company to a complete stranger. Get as much feedback on this from trusted advisors/investors/founders as it’ll be the primary way investors first come across your product.

Get your deck handy: at the pre-seed stage, try to keep slides to < 15. Use handy resources like the video linked below to build an engaging, visual-first deck.

Practice and record your pitch: build and practice a script for each slide. Once you feel confident with the narrative (ask for feedback!), record a short 5-min narrated version so you can speed up investor conversations. Here’s a 30 second snippet from my personal pitch along with an awesome resource from On Deck on crafting a fundable pitch.

Build your investor list: search through investors who funded founders in your network or folks you look up to. Jot down their names along with partners. Make sure they invest in your space and haven’t funded your competitor.

Tips on buliding lists: Look through established list of investors like NFX Signal, VCSheet, or Space Cadet to identify potential investors. If you need more, Google is your friend (i.e. search “enterprise SaaS pre-seed investors in Canada”)

Create your interactive product demo: investors want to see what you’ve built — your product will do a much better job of illustrating what you do vs. words or videos that may never watched. Here’s an example of what we built using Supademo:

Get data room handy: make sure you have access to core metrics like MRR, LTV, Churn, Retention, etc. In addition, identify key customers that would be willing to be references and make sure you’re friendly with them in case of pending due diligence.

Days 7–15: Request Intros

Nowadays, there are a ton of platforms that aim to democratize access to investors. SeedChecks, Handwave are great examples of this.

Personally, I still prefer to get warm intros from other founders to cut past the noise, especially during a time when VCs are not in a hurry to deploy capital.

To do this:

- Look at your network (direct or adjacent) and identify everyone that has raised for their current or past company

- Make a list of all of the investors they are connected with (add this to the Notion doc mentioned above)

- Ensure the fund thesis aligns with your company and that they haven’t invested in a direct competitor

- Put a heavy emphasis on identifying investors that can lead rounds first as leads are the biggest determinants of whether you’ll successfully raise or not

You can quickly determine which investors lead by (1) their check size, (2) track record, and (3) reading their website (usually they explicitly mention they lead or follow rounds).

Once you have the list handy, reach out to the specific founder with an intro request. Make it as easy as possible for founders or investors to introduce you — create personalized blurbs where all they need to do is forward it off. Show you’ve done your research by personalizing each email with info on the specific fund and their thesis.

Aim for ~100 warm intro requests with an anticipated conversion rate of 60% for double-opt-ins. Make sure you follow up often as founders are busy and this might not be their top priority.

Focus on warm intros to lead investors (and it’s partners) FIRST who can write a significant % of your round vs. spray and pray. Once the lead is in place, everything naturally follows (FOMO)

Finally, when thinking through intros — don’t ask/accept intros from investors that passed on your company. It’s a bad signal.

Days 15–30: Meet and Iterate

If you’ve followed the earlier steps (and have a “venture-backable” company), you’ll likely have a number of investors that double opt-in to an initial conversation.

Start to get these scheduled and push for high density (i.e. bucket meetings together in one week). Having the density of meetings will create FOMO, drive momentum, and help you close faster.

Target 3–5 investor meetings every single day — which means you need to have a strong pipeline of warm intros.

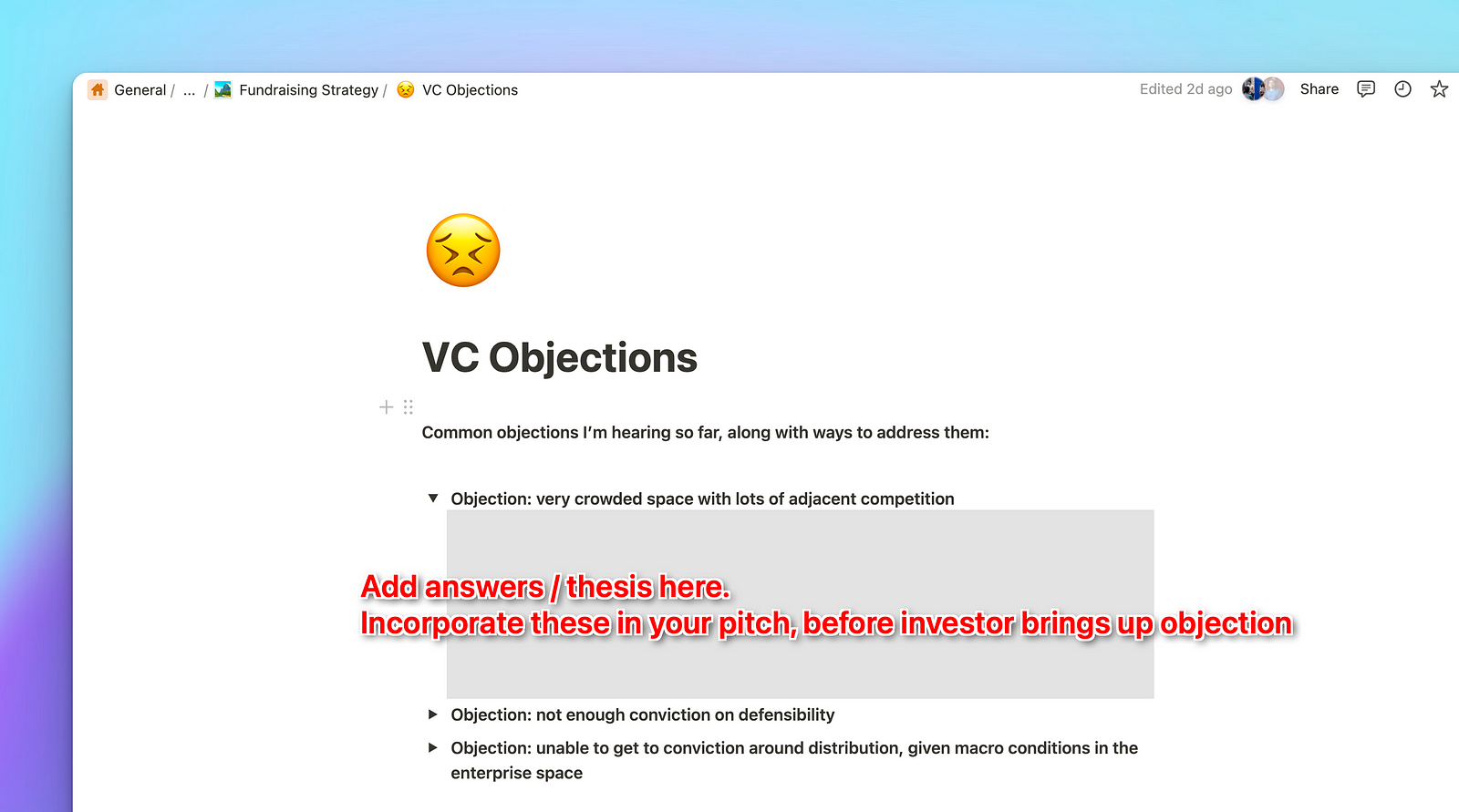

Throughout these meetings, write down objections from every investor that passes. Update and address these by tweaking your pitch or presentation accordingly.

As mentioned before, be prepared for a string of rejections and be ready to expect 20–30 no’s for every yes.

Once you have interest from a potential lead, aim to communicate via text or WhatsApp instead of email. This will drive velocity and quickly suss out whether the investor is serious or not.

Days 30+: Due diligence

If you’ve played your cards right, you’ll likely start to do some due diligence with a handful of potential leads.

This is where you should have your data room and metrics handy from your Day 0 preparations.

Continue to highlight how you can be a BIG company (even if your initial product is an initial, smaller wedge) and connect the investor to personal references and customers that will go to bat for you. These references can make or break the investment so choose them wisely.

Hopefully, by the end of this sequence you have a term sheet in tow from one of our desired investors. You can then start negotiating terms (a great guide to term sheets here) and looping in follow-on investors to generate velocity for closing.

Good luck and don’t hesitate to reach out if I can be helpful :)

Joseph Lee